What Does a Tax Agent Do? Full Guide to Their Roles and Benefits

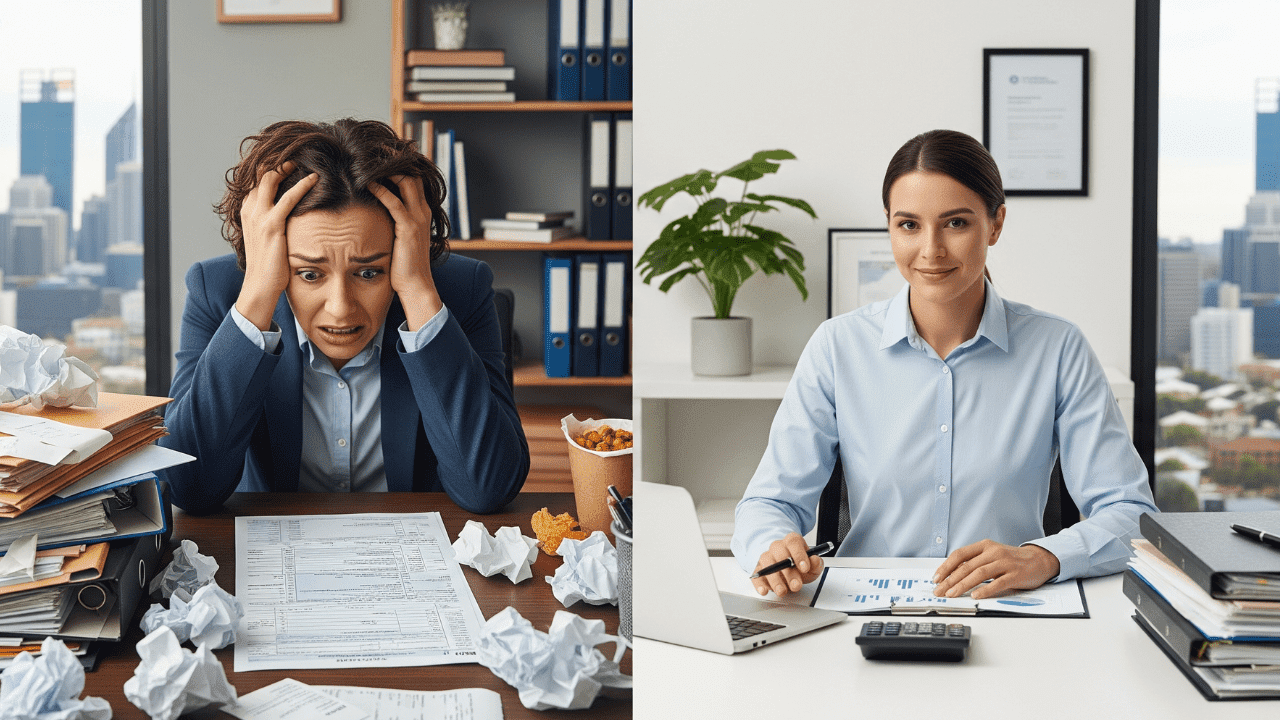

If you run a business or manage finances in Malagawa, WA, understanding what a tax agent actually does can save you a lot of time, […]

2025 Tax Planning for Perth Small Businesses: Top Strategies

Running a small business in Perth, Western Australia, can be exciting and rewarding, but it also comes with financial responsibilities. One area that often needs […]

Company Liquidation vs Administration: Which Option is Best for Your Perth Business?

Running a business in Perth, Western Australia, can be rewarding but challenging. At times, a business may face financial pressure that requires tough decisions. When […]

Maximise Tax Refund in Perth: Essential Deductions for Individuals

Tax time can feel overwhelming, but it’s also a chance to put money back in your pocket. If you live or work in Perth, Western […]

How to Charge, Collect, and Report GST in Perth

The goods and services tax (GST) is a 10% tax on most products and services in Australia. If your Perth-based business has a turnover of […]

Financial Accounting vs Other Accounting: What to Know

Accounting is the process of recording, classifying, and summarising financial information to support better decision-making. As a discipline, it covers multiple functions, some focused on […]